A high school level course offered in New Jersey focusing on the application of algebraic concepts to personal finance topics provides students with practical skills for managing money. Such a course might cover budgeting, saving, investing, borrowing, and understanding interest rates, all through the lens of mathematical principles. An example topic could be calculating compound interest on investments using exponential functions.

Equipping young adults with sound financial literacy is crucial for their future economic well-being. This type of curriculum empowers students to make informed decisions regarding their finances, potentially leading to greater financial security and independence. While traditional algebra courses often focus on abstract concepts, this specialized approach connects mathematics to real-world scenarios relevant to every student’s life. The increasing complexity of financial products and markets underscores the growing need for this kind of practical financial education at a younger age.

This discussion will further explore the specific topics covered in a New Jersey high school financial mathematics course, the learning objectives for students, and the potential long-term impacts of such a curriculum on individual financial health and the broader economy.

Tips for Success in Financial Mathematics

Strong mathematical foundations and an understanding of core financial concepts are essential for success in a financially focused mathematics course. The following tips offer guidance for navigating this curriculum effectively.

Tip 1: Master foundational algebraic principles. A solid grasp of linear equations, exponents, and logarithms is crucial for understanding complex financial calculations. Reviewing these concepts before and during the course can significantly improve comprehension.

Tip 2: Develop strong problem-solving skills. Financial mathematics involves applying mathematical concepts to real-world scenarios. Practicing problem-solving techniques and working through diverse examples will enhance the ability to analyze financial situations effectively.

Tip 3: Understand basic financial terminology. Familiarization with terms like interest rates, principal, compounding, and amortization is essential. Creating a glossary of key terms and reviewing their definitions regularly can aid comprehension.

Tip 4: Utilize online resources and tools. Numerous websites and applications offer financial calculators and simulations that can help visualize and understand financial concepts. Exploring these resources can provide practical experience.

Tip 5: Seek clarification when needed. Don’t hesitate to ask the instructor for assistance with challenging concepts or problems. Forming study groups with classmates can also provide valuable peer support and collaborative learning opportunities.

Tip 6: Relate concepts to real-world situations. Connect the mathematical principles learned in the course to personal financial decisions. This approach can enhance understanding and demonstrate the practical relevance of the material.

Tip 7: Practice consistently. Regular practice is essential for mastering financial mathematics. Working through problems regularly, rather than cramming before exams, will improve retention and application of concepts.

By implementing these strategies, students can build a solid understanding of financial mathematics and develop valuable skills for managing their finances effectively throughout their lives. These skills will contribute not only to individual financial well-being but also to broader economic stability.

This concludes the discussion of practical tips for maximizing success in a financial mathematics course. The following section will summarize the key takeaways and offer final recommendations for students.

1. Practical Application of Algebra

Practical application of algebra forms the core of a financial algebra course offered in New Jersey high schools. Instead of abstract manipulations, students learn to utilize algebraic concepts to solve real-world financial problems. This connection transforms theoretical knowledge into a powerful tool for managing personal finances. For example, understanding exponential functions becomes essential for calculating compound interest, enabling students to project investment growth and make informed saving decisions. Linear equations become the basis for developing and analyzing budgets, allowing for careful allocation of resources and planning for future expenses. The curriculum bridges the gap between abstract mathematical concepts and concrete financial scenarios, providing students with the skills to navigate complex financial situations effectively.

Further applications emerge in areas such as loan amortization and mortgage calculations. Students can utilize algebraic formulas to determine monthly payments, understand the impact of interest rates, and compare different loan options. This practical approach empowers informed borrowing decisions, mitigating the risks associated with debt. Furthermore, algebraic principles can be applied to analyze investment portfolios, understand stock market fluctuations, and evaluate the potential risks and rewards of different investment strategies. By acquiring these practical skills, students develop a stronger sense of financial control and responsibility, laying a foundation for long-term financial well-being.

In summary, the practical application of algebra in a financial algebra course provides students with a tangible link between mathematical theory and real-world financial management. This connection fosters financial literacy, encourages responsible financial decision-making, and equips students with the tools necessary for navigating the complexities of personal finance. The skills acquired through this practical approach contribute significantly to individual financial health and, ultimately, to broader economic stability. The emphasis on application ensures that students not only understand the “how” of algebraic manipulation but also the “why” of its relevance in their lives, promoting a deeper appreciation for the power of mathematics in everyday contexts.

2. Real-world financial skills

Real-world financial skills are not merely abstract concepts; they represent the practical application of financial knowledge to everyday situations. A financial algebra course in a New Jersey high school aims to equip students with precisely these skills, bridging the gap between theoretical understanding and practical application. This connection is crucial for fostering financial literacy and empowering students to make informed financial decisions throughout their lives.

- Budgeting and Expense Tracking

Budgeting involves creating a plan for managing income and expenses. In a financial algebra course, students learn to apply algebraic principles to create and analyze budgets, track spending, and adjust financial plans as needed. Real-world examples include developing a personal budget for tracking monthly expenses, creating a budget for a school club or event, or analyzing the financial implications of various spending habits. This skill empowers informed spending decisions and promotes responsible financial management.

- Saving and Investing

Understanding how to save and invest effectively is critical for long-term financial security. Financial algebra courses explore the mathematics of saving and investing, including concepts like compound interest, investment returns, and risk assessment. Students might analyze different savings plans, compare investment options, or project the long-term growth of investments under various market conditions. These skills are essential for building wealth and achieving financial goals.

- Debt Management and Borrowing

Navigating debt responsibly is a crucial life skill. Financial algebra courses address the mathematics of borrowing, including loan calculations, interest rates, and amortization schedules. Students might calculate the total cost of a loan, compare different loan terms, or analyze the impact of interest rates on borrowing decisions. This knowledge empowers informed borrowing choices and helps mitigate the risks associated with debt.

- Financial Planning and Goal Setting

Setting financial goals and developing a plan to achieve them is essential for long-term financial success. A financial algebra course provides students with the tools to create financial plans, set realistic goals, and track progress toward those goals. This might involve projecting retirement savings, planning for major purchases, or evaluating the financial implications of different career paths. These skills empower informed financial planning and promote long-term financial stability.

These real-world financial skills, cultivated through a financial algebra course, provide students with a practical toolkit for managing their finances effectively. This connection between mathematical principles and practical application empowers informed decision-making, promotes financial responsibility, and prepares students for a secure financial future. By integrating these skills into the New Jersey high school curriculum, financial algebra courses contribute significantly to individual financial well-being and ultimately to the broader economic landscape.

3. Informed Financial Decisions

Informed financial decisions are not merely educated guesses; they represent the culmination of sound financial literacy and the application of analytical skills to navigate complex financial situations. A financial algebra course in a New Jersey high school directly contributes to this informed decision-making process by providing students with the mathematical tools and conceptual frameworks necessary to evaluate financial options, assess risks, and make choices aligned with individual financial goals. This connection between mathematical knowledge and financial literacy empowers students to take control of their financial well-being and make sound decisions that contribute to long-term financial security.

- Analyzing Investment Opportunities

Analyzing investment opportunities requires more than just following market trends; it necessitates a deep understanding of financial instruments, risk assessment, and return calculations. A financial algebra course equips students with the mathematical tools to analyze investment prospects, compare potential returns, and evaluate the risks associated with various investment vehicles. This might involve calculating compound interest, understanding the impact of inflation on investment returns, or applying statistical methods to assess market volatility. This analytical approach empowers informed investment choices and reduces the likelihood of making impulsive or uninformed investment decisions.

- Evaluating Loan Options

Evaluating loan options requires careful consideration of interest rates, repayment terms, and the total cost of borrowing. Financial algebra provides students with the skills to calculate loan payments, compare different loan offers, and understand the long-term implications of various borrowing choices. This might involve calculating the total interest paid over the life of a loan, comparing the benefits of fixed-rate versus variable-rate loans, or analyzing the impact of different down payment amounts on mortgage terms. This analytical approach empowers informed borrowing decisions, minimizing the potential financial burdens associated with debt.

- Planning for Major Purchases

Planning for major purchases, such as a car or a home, requires careful budgeting, saving strategies, and an understanding of financing options. Financial algebra courses provide students with the mathematical frameworks to develop savings plans, calculate the affordability of major purchases, and evaluate the long-term financial implications of different financing strategies. This might involve creating a budget to save for a down payment, comparing the costs of buying versus leasing a car, or analyzing the impact of property taxes and insurance on homeownership costs. This informed approach to major purchases promotes financial responsibility and reduces the risk of overspending or accumulating excessive debt.

- Developing Long-Term Financial Strategies

Developing long-term financial strategies requires an understanding of retirement planning, estate planning, and long-term investment strategies. Financial algebra provides students with the mathematical tools to project retirement savings, analyze the growth of investments over time, and evaluate the long-term implications of various financial decisions. This might involve calculating the future value of retirement accounts, understanding the impact of inflation on retirement income, or comparing different investment strategies for long-term growth. This forward-thinking approach to financial planning empowers informed decisions that contribute to long-term financial security and a comfortable retirement.

These facets of informed financial decision-making, cultivated through a financial algebra course, provide students with a robust framework for navigating the complexities of personal finance. By integrating these analytical skills within the New Jersey high school curriculum, financial algebra courses not only enhance individual financial literacy but also contribute to a more financially responsible and economically stable society. The emphasis on informed decision-making empowers students to take control of their financial destinies and make choices that align with their long-term goals and aspirations.

4. Preparation for Future Financial Success

Preparation for future financial success represents a crucial outcome of a financial algebra course offered in New Jersey high schools. This preparation is not merely theoretical; it equips students with tangible skills and knowledge directly applicable to navigating the financial realities of adulthood. The course establishes a foundational understanding of financial principles, providing a framework for making informed decisions about budgeting, saving, investing, and borrowing. This proactive approach to financial literacy empowers students to approach future financial challenges with confidence and make sound choices that contribute to long-term financial well-being. For example, understanding the principles of compound interest allows students to appreciate the long-term benefits of saving and investing early, encouraging responsible financial habits from a young age.

The practical significance of this preparation becomes evident in various real-life scenarios. When faced with decisions about student loans, graduates equipped with financial algebra skills can analyze loan terms, compare interest rates, and make informed borrowing choices that minimize long-term debt. When entering the workforce, these individuals can effectively manage their earnings, create budgets, and plan for major purchases like a car or a home. Further, understanding investment principles allows for strategic planning for retirement, maximizing long-term financial security. The skills acquired in a financial algebra course become invaluable tools for navigating the complex financial landscape of adulthood, contributing to greater financial stability and independence.

In summary, a financial algebra course in a New Jersey high school provides a critical foundation for future financial success. This foundation, built on practical application of mathematical concepts to real-world financial scenarios, empowers informed decision-making, promotes responsible financial habits, and equips students with the tools necessary to navigate the complexities of personal finance. The long-term benefits extend beyond individual financial well-being, contributing to a more financially literate and economically stable society. Addressing the challenge of financial illiteracy at a young age through targeted education offers a proactive solution to fostering financial responsibility and empowering future generations to achieve their financial goals.

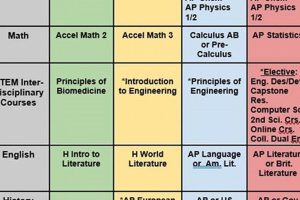

5. New Jersey High School Curriculum

The New Jersey high school curriculum provides a structured framework for education, encompassing a range of subjects designed to prepare students for higher education and future careers. Within this framework, the inclusion of a financial algebra course represents a strategic decision to address the growing need for financial literacy among young adults. This specialized course integrates mathematical principles with practical financial applications, equipping students with the skills necessary to navigate complex financial situations effectively. The curriculum’s emphasis on real-world application ensures that students not only grasp theoretical concepts but also understand their practical significance in everyday life. This connection between curriculum design and real-world application is crucial for fostering financial responsibility and empowering students to make informed financial decisions.

The integration of a financial algebra course within the New Jersey high school curriculum reflects a broader societal recognition of the importance of financial literacy. As financial products and markets become increasingly complex, the need for informed financial decision-making becomes even more critical. By incorporating financial education into the core curriculum, New Jersey is investing in the future financial well-being of its students, equipping them with the tools to navigate the complexities of personal finance, from budgeting and saving to investing and debt management. For example, students learn to apply algebraic concepts to calculate loan interest, compare investment options, and develop long-term financial plans. These practical skills empower students to make informed choices that contribute to their long-term financial stability and security.

In conclusion, the inclusion of a financial algebra course within the New Jersey high school curriculum demonstrates a commitment to preparing students for the financial realities of adulthood. By providing a structured learning environment and integrating practical applications of mathematical concepts, the curriculum fosters financial literacy, encourages responsible financial behavior, and empowers students to make informed decisions that contribute to their future financial success. This proactive approach to financial education not only benefits individual students but also contributes to a more financially literate and economically stable society. Addressing the challenge of financial illiteracy through targeted curriculum development is an investment in the future, laying the groundwork for a generation equipped to navigate the complexities of personal finance with confidence and achieve long-term financial well-being.

6. Enhanced Financial Literacy

Enhanced financial literacy represents a crucial outcome of a financial algebra course offered in New Jersey high schools. This enhancement stems directly from the curriculum’s focus on applying mathematical concepts to real-world financial scenarios. The course provides students with a structured framework for understanding fundamental financial principles, moving beyond abstract theory to practical application. This approach fosters a deeper understanding of financial concepts, empowering informed decision-making and responsible financial behavior. For example, students learn to calculate compound interest, enabling them to understand the long-term benefits of saving and investing. This practical application of mathematical principles solidifies their understanding of financial growth and encourages responsible financial habits.

The practical significance of enhanced financial literacy becomes evident in its impact on various life decisions. Informed borrowing choices, for example, are facilitated by understanding loan terms, interest rates, and the long-term implications of debt. This knowledge, gained through a financial algebra course, empowers students to avoid predatory lending practices and make responsible borrowing decisions. Furthermore, enhanced financial literacy promotes sound investment strategies. Students learn to analyze investment opportunities, assess risks, and make informed choices aligned with their financial goals. This ability to evaluate investment options contributes to building wealth and achieving long-term financial security. Finally, enhanced financial literacy equips individuals to navigate complex financial products and markets, promoting financial independence and reducing vulnerability to financial scams or exploitation. This empowerment fosters greater financial stability and contributes to overall economic well-being.

In conclusion, enhanced financial literacy, cultivated through a financial algebra course in New Jersey high schools, provides students with a critical life skill. This enhanced understanding of financial principles empowers informed decision-making, promotes responsible financial behavior, and fosters long-term financial well-being. The benefits extend beyond individual financial health, contributing to a more financially literate and economically stable society. Addressing the challenge of financial illiteracy through targeted education represents a proactive investment in the future, equipping young adults with the tools necessary to navigate the complexities of personal finance and achieve their financial goals.

Frequently Asked Questions

This section addresses common inquiries regarding financial algebra courses offered in New Jersey high schools. The responses aim to provide clarity and address potential misconceptions.

Question 1: What are the typical prerequisites for enrolling in a financial algebra course?

Prerequisites may vary slightly between schools, but typically include successful completion of Algebra I or an equivalent foundational mathematics course. Some schools may also require a teacher recommendation or a demonstrated interest in finance or business-related subjects.

Question 2: How does financial algebra differ from a traditional algebra course?

While financial algebra incorporates core algebraic principles, its focus lies in applying these principles to real-world financial situations. Traditional algebra courses often emphasize abstract concepts, whereas financial algebra connects mathematical concepts to practical financial applications such as budgeting, investing, and debt management.

Question 3: Does this course prepare students for college-level mathematics courses?

While financial algebra may not directly align with the calculus track typically required for STEM majors, it provides valuable quantitative reasoning and problem-solving skills applicable to a wide range of college majors. Additionally, the financial literacy gained can benefit students regardless of their chosen field of study.

Question 4: Are there opportunities for extracurricular activities or competitions related to financial algebra?

Some schools may offer extracurricular clubs or competitions related to finance or business, such as the Future Business Leaders of America (FBLA) or DECA. These activities can provide students with opportunities to apply the skills learned in financial algebra and further develop their interest in finance.

Question 5: How is technology incorporated into the financial algebra curriculum?

Technology plays an integral role in modern financial algebra courses. Students may use financial calculators, spreadsheets, and online simulations to model financial scenarios, analyze data, and develop practical financial skills. Some curricula also incorporate financial literacy software or online learning platforms to enhance the learning experience.

Question 6: What career paths might a student interested in financial algebra consider?

A strong foundation in financial algebra can open doors to various career paths in finance, business, and related fields. Potential career options include financial analyst, financial planner, accountant, actuary, and business manager. The analytical and problem-solving skills developed in the course are also valuable in many other professions.

Understanding the nuances of a financial algebra course can help students and parents make informed decisions about course selection and future academic planning. The practical skills and knowledge gained through this course can significantly contribute to long-term financial well-being and career success.

The following section will explore real-world examples and case studies demonstrating the practical application of financial algebra principles.

Conclusion

Financial algebra courses offered within New Jersey’s high school system represent a significant step towards equipping students with essential life skills. This curriculum bridges the gap between abstract mathematical concepts and practical financial applications, empowering students to navigate the complexities of personal finance with greater confidence and competence. The integration of algebraic principles with real-world financial scenarios, from budgeting and saving to investing and debt management, provides a robust foundation for informed financial decision-making. This foundation is crucial for navigating the financial challenges and opportunities of adulthood, contributing to greater financial stability and independence.

The long-term implications of incorporating financial algebra into the high school curriculum extend beyond individual financial well-being. A financially literate populace contributes to a stronger and more stable economy. By investing in the financial education of young adults, New Jersey is fostering a generation equipped to make sound financial choices, build wealth responsibly, and contribute to a more secure financial future for themselves and the broader community. The emphasis on practical application and real-world relevance ensures that these skills are not merely theoretical but translate into tangible benefits, empowering informed decision-making and fostering a future generation of financially responsible citizens. Continued support and expansion of these educational initiatives are crucial for ensuring widespread access to this vital life skill.