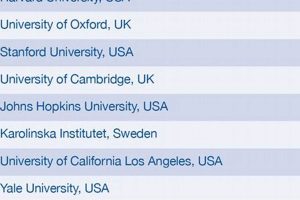

Elite universities with esteemed finance programs, strong alumni networks within the financial sector, and rigorous curricula focused on financial modeling, valuation, and deal structuring often serve as prime gateways to careers in investment banking. These institutions typically offer specialized master’s programs, such as MBAs and Master’s in Finance, alongside robust undergraduate business programs. Students gain practical experience through case studies, internships with leading banks, and interactions with industry professionals.

A strong academic foundation from a well-regarded institution provides a competitive edge in the highly selective investment banking recruitment process. Graduates of these programs benefit from extensive career support services, established relationships with recruiters, and a network of alumni who can provide mentorship and access to opportunities. Historically, certain universities have developed strong reputations within the industry, leading to a preference for their graduates among top-tier investment banks. This tradition of excellence often contributes to a self-reinforcing cycle of successful placement.

Further exploration will encompass key factors influencing university selection, specific program features, and strategies for maximizing career prospects within investment banking. A detailed examination of various institutions known for placing graduates in this competitive field will also be provided.

Successfully securing a position in investment banking requires strategic planning and dedicated effort. The following tips offer guidance for individuals targeting this competitive career path.

Tip 1: Develop Strong Quantitative Skills: A solid foundation in mathematics, financial modeling, and data analysis is essential. Proficiency in Excel and other analytical tools is highly valued.

Tip 2: Cultivate Networking Opportunities: Actively engage with industry professionals through career fairs, networking events, and informational interviews. Building relationships with alumni and recruiters can provide valuable insights and potential opportunities.

Tip 3: Seek Relevant Practical Experience: Internships, particularly those within investment banks or related financial institutions, offer crucial practical experience and demonstrate commitment to the field.

Tip 4: Focus on Academic Excellence: Strong academic performance in relevant coursework, such as finance, accounting, and economics, is a key indicator of potential.

Tip 5: Demonstrate Strong Communication Skills: Effective communication, both written and verbal, is critical for success in a collaborative and client-facing environment. Practice clear and concise articulation of complex financial concepts.

Tip 6: Research and Understand the Industry: A deep understanding of the investment banking landscape, including various roles, transactions, and current market trends, demonstrates genuine interest and preparedness.

Tip 7: Prepare for the Technical Interview: Master technical concepts related to valuation, financial modeling, and accounting principles. Practice common interview questions and case studies.

By focusing on these key areas, individuals can significantly enhance their candidacy and increase their chances of success in the competitive investment banking recruitment process.

These strategies provide a solid foundation for pursuing a career in investment banking. Next, we will delve deeper into specific institutional offerings and resources available to aspiring investment bankers.

1. Curriculum Rigor

Curriculum rigor serves as a cornerstone of institutions renowned for placing graduates in competitive investment banking roles. A demanding curriculum equips students with the analytical skills, financial acumen, and theoretical knowledge necessary to navigate the complexities of the industry. This section explores key facets of a rigorous curriculum that contribute to success in investment banking.

- Emphasis on Financial Modeling and Valuation:

Rigorous programs emphasize practical application through extensive financial modeling and valuation exercises. Students develop proficiency in building complex models, conducting sensitivity analyses, and utilizing various valuation methodologies. This hands-on experience translates directly to the day-to-day tasks of an investment banker.

- Theoretical Foundations in Finance and Economics:

A strong theoretical grounding in financial markets, corporate finance, and economic principles is essential. Advanced coursework in these areas provides the framework for understanding market dynamics, investment strategies, and the broader economic context within which investment banking operates. Examples include in-depth studies of portfolio theory, derivatives pricing, and econometrics.

- Case Study Analysis and Practical Application:

Case studies provide opportunities to apply theoretical knowledge to real-world scenarios. Analyzing complex business situations, developing strategic recommendations, and presenting findings hone critical thinking and problem-solving skills crucial for success in the fast-paced investment banking environment.

- Focus on Accounting and Financial Statement Analysis:

A deep understanding of accounting principles and financial statement analysis is paramount. Rigorous programs delve into complex accounting topics, enabling students to interpret financial statements, assess company performance, and identify potential investment opportunities or risks.

These core components of a rigorous curriculum collectively contribute to the development of well-rounded graduates prepared for the challenges of investment banking. Institutions prioritizing these elements often achieve higher placement rates within top-tier firms, reinforcing their reputation as leading programs for aspiring investment bankers. Furthermore, the combination of theoretical knowledge and practical application provides a competitive edge in the recruitment process and lays a strong foundation for long-term career success in the field.

2. Faculty Expertise

Faculty expertise is a critical differentiator among institutions aspiring to prepare students for careers in investment banking. Distinguished faculty members with practical industry experience and significant research contributions bring unparalleled value to these programs. Their insights, gleaned from years of working in the field, provide students with a realistic perspective on the challenges and opportunities within investment banking. For example, a professor who has structured complex financial transactions can offer nuanced perspectives beyond textbook theory, enriching students’ understanding of deal structuring, valuation, and negotiation dynamics. Similarly, faculty actively engaged in cutting-edge research contribute to the body of knowledge in finance, informing curriculum development and exposing students to the latest advancements in the field. This connection to current research not only enhances the academic experience but also equips graduates with a forward-looking perspective, highly valued by prospective employers.

The presence of accomplished faculty attracts high-caliber students, creating a stimulating learning environment where peers challenge and inspire each other. Faculty with extensive professional networks can facilitate connections between students and industry professionals, opening doors to internships and mentorship opportunities. For instance, a professor with prior experience at a leading investment bank may be able to connect students with recruiters or alumni working at the firm, providing a crucial advantage in the competitive recruitment process. Furthermore, experienced faculty members possess a deep understanding of the skills and qualities sought by employers in the investment banking industry. They can tailor their teaching and mentorship to address these specific requirements, effectively preparing students for the rigorous interview process and the demands of the profession.

In conclusion, faculty expertise is not merely a desirable attribute but a fundamental component of leading investment banking programs. Institutions with accomplished faculty offer students a distinct advantage, combining academic rigor with practical insights and industry connections. This blend of theoretical knowledge and real-world experience prepares graduates to excel in the demanding and competitive world of investment banking. Choosing a program with a strong faculty presence can significantly impact a student’s career trajectory, providing a pathway to success in this challenging yet rewarding field. The combination of rigorous academics, practical experience, and industry connections ultimately determines a program’s effectiveness in preparing students for successful careers in investment banking.

3. Alumni Network

A robust alumni network is a hallmark of institutions recognized for excellence in placing graduates within top-tier investment banking firms. This network serves as a crucial bridge connecting students with established professionals in the field, fostering mentorship opportunities, and providing valuable insights into the industry. The strength and breadth of an alumni network significantly influence a graduate’s career prospects, particularly within the competitive landscape of investment banking.

- Mentorship and Career Guidance:

Alumni networks provide access to experienced professionals willing to mentor students and offer guidance on career paths within investment banking. This mentorship can prove invaluable in navigating the complexities of the industry, providing personalized advice on skill development, networking strategies, and interview preparation. For example, an alumnus working in mergers and acquisitions could mentor a student interested in that specialization, offering insights into deal structuring, valuation techniques, and career progression within that specific area.

- Networking and Job Opportunities:

Established alumni networks often create a pipeline of talent for investment banks. Alumni frequently play a key role in recruitment efforts, recommending promising candidates from their alma mater. This insider perspective can provide a significant advantage in the competitive application process, leading to internships and full-time offers. For instance, an alumnus working at a bulge bracket firm might alert students to open positions, provide referrals, or offer insights into the firm’s culture and recruitment preferences.

- Industry Insights and Market Intelligence:

Alumni working in diverse roles within investment banking can offer current market intelligence and insights into emerging trends. These perspectives provide students with a real-time understanding of industry dynamics, enhancing their academic learning and preparing them for the challenges and opportunities of a constantly evolving financial landscape. For example, an alumnus working in private equity could share insights into current investment trends, valuation multiples, and deal flow, providing students with a practical understanding of market conditions.

- Professional Development and Continuing Education:

Alumni networks often organize workshops, seminars, and networking events that offer continuing education and professional development opportunities. These events allow students and recent graduates to stay abreast of industry developments, expand their skill sets, and further cultivate their professional networks. For example, an alumni chapter might host a workshop on financial modeling techniques led by a senior investment banker, providing valuable practical training and networking opportunities.

The strength of an alumni network is a key indicator of an institution’s commitment to student success within investment banking. A well-established and engaged alumni network provides unparalleled access to mentorship, career guidance, and industry connections, significantly enhancing a graduate’s prospects in this competitive field. This network effect contributes substantially to the long-term career trajectory of graduates, solidifying the reputation of these institutions as premier training grounds for future investment banking leaders. Therefore, when evaluating programs, the depth and breadth of the alumni network should be a primary consideration for aspiring investment bankers.

4. Placement Success

Placement success serves as a crucial metric for evaluating institutions frequently associated with excellence in investment banking education. A consistent track record of placing graduates in reputable firmsparticularly bulge bracket investment banks, elite boutique firms, and prestigious asset management companiesdirectly correlates with an institution’s perceived strength and effectiveness in preparing students for this demanding career path. This success often creates a self-reinforcing cycle, attracting high-achieving students seeking optimal career outcomes and further strengthening the institution’s reputation within the industry. For example, a university consistently placing a significant percentage of its finance graduates in top-tier investment banks will likely attract a larger pool of highly qualified applicants in subsequent years, further enhancing its selectivity and reputation.

Several factors contribute to an institution’s placement success. A rigorous curriculum focused on financial modeling, valuation, and transaction advisory provides students with the technical skills required by employers. Furthermore, strong career services departments offering tailored guidance on resume and cover letter writing, interview preparation, and networking strategies play a critical role. Targeted networking events with representatives from leading financial institutions create opportunities for students to connect with potential employers and showcase their skills. Finally, robust alumni networks within the finance industry can provide invaluable mentorship, career advice, and access to job opportunities. For instance, an institution with a strong alumni presence at a specific investment bank may have a higher likelihood of placing graduates within that firm due to established relationships and internal referrals.

Understanding the connection between placement success and institutional reputation is crucial for prospective students considering a career in investment banking. Researching an institution’s placement statistics, including the types of firms where graduates are employed and the average starting salaries, provides valuable insights into the potential return on investment of a particular program. However, it is essential to consider placement success in conjunction with other factors, such as curriculum rigor, faculty expertise, and the overall learning environment, to make a well-informed decision. Ultimately, selecting an institution with a strong track record of placing graduates in desired roles significantly enhances an individual’s prospects of securing a competitive position in the investment banking industry. This understanding empowers aspiring investment bankers to make strategic educational choices aligned with their career aspirations.

5. Career Resources

Institutions recognized for placing graduates in competitive investment banking positions provide comprehensive career resources integral to student success. These resources bridge the gap between academic preparation and the practical demands of the recruitment process, offering targeted support and industry-specific guidance. The effectiveness of these services significantly influences graduates’ prospects within the highly competitive investment banking landscape. Access to robust career resources distinguishes top programs, enhancing their appeal to aspiring finance professionals.

- Dedicated Career Advisors:

Specialized career advisors with expertise in the financial services industry provide personalized guidance throughout the recruitment process. These advisors assist students with resume and cover letter development, interview preparation, and networking strategies tailored to investment banking. They may also offer insights into specific firms, industry trends, and potential career paths. For instance, an advisor might help a student tailor their resume to highlight relevant skills for a specific role within mergers and acquisitions or provide feedback on their performance in mock interviews simulating the actual recruitment process at a target firm. This individualized support significantly enhances students’ preparedness and competitiveness.

- Networking Events and Workshops:

Targeted networking events and workshops connect students with recruiters and professionals from leading investment banks. These events facilitate valuable interactions, allowing students to build relationships, gain industry insights, and explore potential career opportunities. Workshops focused on technical skills development, such as financial modeling and valuation, provide practical training relevant to the demands of investment banking roles. For example, a workshop might focus on building leveraged buyout models in Excel, a crucial skill for aspiring investment bankers. These interactive sessions enhance students’ technical proficiency and demonstrate their commitment to the field to potential employers.

- Mock Interviews and Assessment Centers:

Mock interviews and assessment centers simulate the rigorous recruitment process employed by investment banks. These simulations provide students with valuable practice in answering technical questions, solving case studies, and demonstrating their analytical and communication skills under pressure. Constructive feedback from experienced professionals helps students identify areas for improvement, enhancing their performance in actual interviews and assessment centers. This practical experience builds confidence and reduces anxiety, increasing the likelihood of success in the competitive recruitment process.

- Online Resources and Job Boards:

Comprehensive online resources and job boards provide access to a wide range of internship and full-time opportunities within investment banking. These platforms often feature exclusive listings from partner firms, increasing students’ exposure to relevant roles and streamlining the application process. Resources such as industry-specific databases, career guides, and alumni directories further enhance students’ job search efforts. For example, an online portal might aggregate internship postings from various investment banks, allowing students to efficiently explore opportunities and submit applications through a centralized platform. This streamlined access to relevant opportunities simplifies the job search process and maximizes students’ chances of securing desired positions.

The efficacy of career resources significantly influences an institution’s ability to successfully place graduates in competitive investment banking roles. Comprehensive career services, coupled with a strong academic foundation, contribute to the overall value proposition offered by top programs. These resources empower students to navigate the complex recruitment process, effectively showcase their skills, and ultimately achieve their career aspirations within the demanding yet rewarding field of investment banking. By strategically leveraging these resources, graduates gain a distinct competitive advantage, positioning themselves for success in this challenging industry.

6. Global Opportunities

Exposure to global financial markets and cross-cultural experiences is increasingly vital for success in investment banking. Institutions recognized for strength in this area offer programs with international components, fostering a global perspective essential for navigating the interconnected world of finance. These opportunities enhance students’ understanding of diverse regulatory environments, market dynamics, and transaction structures across borders. For instance, studying abroad at a university in a major financial hub like London or Hong Kong provides firsthand exposure to international markets and networking opportunities with global firms. Furthermore, participation in international case competitions or consulting projects allows students to apply their skills in diverse contexts, developing adaptability and cross-cultural communication skills highly valued by multinational investment banks. These experiences cultivate a global mindset, preparing graduates to effectively engage with clients and colleagues from diverse backgrounds.

The practical significance of global opportunities extends beyond theoretical knowledge. International internships with investment banks or multinational corporations offer invaluable practical experience in navigating cross-border transactions and understanding the nuances of different financial markets. Such experiences demonstrate a commitment to global finance and provide a competitive edge in the recruitment process. For example, an internship with a bank in emerging markets could expose a student to unique investment opportunities and challenges, differentiating them from candidates with solely domestic experience. Moreover, institutions with strong global partnerships often facilitate student exchanges and dual-degree programs, allowing students to gain exposure to diverse academic perspectives and build international networks. These connections can prove instrumental in accessing global career opportunities after graduation. Developing a strong understanding of international finance and building a global network positions graduates for success in an increasingly interconnected industry.

In conclusion, global opportunities are no longer a supplementary advantage but a core requirement for aspiring investment bankers. Institutions providing robust international programs cultivate graduates equipped to navigate the complexities of global finance. The ability to analyze cross-border transactions, understand diverse regulatory environments, and work effectively with international clients is crucial for success in today’s interconnected financial world. By seeking and leveraging global opportunities, students enhance their marketability, gain a broader perspective on the industry, and position themselves for leadership roles in the global arena of investment banking. This global perspective is not merely a desirable asset but a fundamental requirement for success in the evolving landscape of international finance.

Frequently Asked Questions

This section addresses common inquiries regarding the pursuit of investment banking careers and the role of educational institutions in this process.

Question 1: Does attending a top-ranked university guarantee placement in investment banking?

While a prestigious university provides advantages, placement is not guaranteed. Success depends on individual performance, networking efforts, and market conditions.

Question 2: Are there alternative paths to investment banking besides attending elite universities?

While less common, successful careers can be built through strong performance at less prominent institutions combined with exceptional networking and relevant experience. Demonstrated aptitude and practical skills remain crucial.

Question 3: How important are networking and internships for securing investment banking positions?

Networking and internships are essential. Building industry connections and gaining practical experience significantly enhance candidacy and provide a competitive edge.

Question 4: What academic disciplines are most relevant for investment banking?

Finance, accounting, and economics provide strong foundational knowledge. Additional relevant fields include mathematics, business administration, and legal studies.

Question 5: How can international students enhance their prospects within investment banking?

International students benefit from strong academic performance, fluency in multiple languages, and demonstrating adaptability to diverse cultural environments. Understanding global markets and regulations is also highly advantageous.

Question 6: What distinguishes successful investment banking candidates from their peers?

Successful candidates possess a combination of strong analytical skills, financial acumen, effective communication, and a demonstrated commitment to the industry. Practical experience, networking abilities, and a proactive approach to career development are also key differentiators.

Careful consideration of these questions clarifies common misconceptions and provides a realistic perspective on the path to investment banking. Thorough research and strategic planning are essential for navigating this competitive landscape successfully.

The next section explores additional resources for individuals seeking further information on careers in investment banking and the educational pathways available.

Conclusion

Institutions known for strong placement within investment banking provide a combination of rigorous academic training, extensive industry connections, and robust career support services. Key factors influencing successful placement include curriculum rigor, faculty expertise, a robust alumni network, proven placement success, comprehensive career resources, and access to global opportunities. These elements collectively contribute to a competitive advantage for graduates seeking entry into this demanding field.

Strategic selection of an educational institution plays a critical role in navigating the competitive landscape of investment banking recruitment. Thorough research, thoughtful self-assessment, and a proactive approach to career development are essential for individuals seeking to maximize their potential within this challenging yet rewarding industry. The pursuit of excellence in education and professional development remains paramount for sustained success in the dynamic world of finance.