The system of compensation for employees of a specific South Carolina public school district involves a structured timeline for distributing salaries and wages. This framework typically outlines the frequency of payment (e.g., bi-weekly, monthly), pay dates, and the methods by which employees can access their earnings (e.g., direct deposit, physical checks). A concrete example would be a calendar showing specific dates for salary disbursements throughout the academic year, including details regarding holiday adjustments and potential delays.

A clearly defined compensation timetable provides financial stability and predictability for district employees, allowing for effective budgeting and personal financial planning. Consistent and reliable payment processing reduces administrative burdens on the district and fosters a positive work environment. Historical context may reveal evolving practices in compensation delivery, reflecting broader trends in payroll management and technological advancements. Access to this information empowers employees to manage their finances effectively and understand the processes behind their compensation.

This foundational understanding of employee compensation distribution facilitates a deeper exploration of related topics, such as understanding paystubs, navigating payroll inquiries, and accessing relevant resources for financial wellness. Further information could cover topics like tax withholding, retirement contributions, and other aspects of compensation.

Accessing and understanding compensation details is crucial for effective financial planning. The following tips offer guidance for navigating these processes efficiently.

Tip 1: Maintain Accurate Personal Information: Ensure contact details and banking information are current to avoid payment delays or misdirection. Regularly review employee portals or contact human resources to verify data accuracy.

Tip 2: Understand Pay Stub Components: Familiarize oneself with the various deductions and contributions listed on pay statements (e.g., taxes, insurance, retirement). This knowledge facilitates accurate budgeting and financial tracking.

Tip 3: Utilize Online Resources: Many organizations offer online portals for employees to access pay stubs, tax forms, and other relevant compensation documents. Leveraging these resources promotes self-service and timely access to information.

Tip 4: Plan for Tax Season: Be aware of deadlines for accessing tax documentation (e.g., W-2 forms) and understand how compensation affects tax liabilities. Consult tax professionals for personalized guidance.

Tip 5: Address Discrepancies Promptly: Report any payroll inconsistencies or errors to the appropriate department (e.g., payroll, human resources) immediately. Clear documentation and communication are essential for resolving issues efficiently.

Tip 6: Explore Financial Wellness Programs: Many employers offer resources to support employees’ financial well-being, such as budgeting workshops or retirement planning seminars. Taking advantage of these opportunities can enhance financial literacy and long-term stability.

Tip 7: Secure Sensitive Information: Treat pay stubs and other compensation documents as confidential information. Securely store physical copies and protect digital access with strong passwords.

Proactive engagement with compensation information contributes to financial security and informed decision-making. By following these tips, individuals can effectively manage their earnings and plan for their financial future.

By understanding the details of compensation and utilizing available resources, employees can gain a greater sense of financial control and stability, paving the way for a more secure financial future.

1. Payment Frequency

Payment frequency is a critical component of the Horry County Schools payroll schedule. It dictates how often employees receive their compensation, directly impacting their financial planning and budgeting. Understanding this aspect of the payroll system is essential for managing personal finances effectively.

- Standard Payment Cycles:

Most school districts operate on a standard payment cycle, typically bi-weekly or monthly. A bi-weekly schedule results in 26 paychecks per year, while a monthly schedule results in 12. The specific cycle adopted by Horry County Schools impacts how employees allocate funds for expenses and savings. For example, budgeting with bi-weekly paychecks requires accounting for two income streams per month.

- Impact on Budgeting:

Payment frequency significantly influences budgeting practices. More frequent payments (e.g., bi-weekly) provide a steadier cash flow, facilitating consistent expense management. Less frequent payments (e.g., monthly) require more diligent planning and larger reserves to cover expenses between pay periods.

- Relationship to Contract Terms:

The payment frequency is often stipulated in employment contracts and collective bargaining agreements. These agreements outline the specific terms of compensation, including how often payments are disbursed. Understanding these terms ensures employees are aware of their payment schedule and can address any discrepancies.

- Implications for Financial Stability:

Consistent and predictable payment cycles contribute to financial stability for employees. Knowing when and how much to expect facilitates responsible financial management, reduces reliance on short-term credit solutions, and supports long-term financial goals.

Understanding the payment frequency within the Horry County Schools payroll schedule is fundamental for employees to effectively manage their personal finances. This understanding empowers individuals to create realistic budgets, anticipate expenses, and achieve financial stability. This knowledge also promotes transparency and predictability within the compensation system.

2. Pay Dates

Pay dates are integral to the Horry County Schools payroll schedule, representing the specific days on which employees receive their compensation. Precise knowledge of these dates is crucial for effective personal financial management, allowing employees to anticipate income and plan expenditures accordingly. Understanding the nuances of pay dates within the broader payroll system contributes to financial stability and informed decision-making.

- Regular Payday Consistency:

Maintaining consistent, predictable pay dates fosters financial stability for employees. Regularity allows for effective budgeting, timely bill payment, and reduces financial anxiety. For example, a consistent bi-weekly payday on Fridays allows employees to reliably anticipate and manage their finances.

- Holiday Adjustments and Variations:

Holidays impacting regular business operations often necessitate adjustments to standard pay dates. The Horry County Schools payroll schedule likely outlines protocols for handling these variations. For instance, if a payday falls on a holiday, the payment may be issued on the preceding business day. Understanding these adjustments is critical for maintaining consistent cash flow.

- Communication and Transparency:

Clear communication of pay dates is essential. Timely notification of any changes to the regular schedule, due to holidays or unforeseen circumstances, allows employees to adjust their financial plans accordingly. Transparent communication minimizes potential disruptions and maintains trust.

- Access to Pay Date Information:

Ready access to pay date information is vital. This information should be easily accessible through various channels, such as employee portals, official communications, or human resources departments. Easy access empowers employees to stay informed and manage their finances proactively.

Accurate knowledge of pay dates within the Horry County Schools payroll schedule empowers employees to manage their financial obligations effectively. This understanding contributes to overall financial well-being and reinforces the importance of a transparent and reliable payroll system.

3. Direct Deposit

Direct deposit plays a significant role within the Horry County Schools payroll schedule, offering a streamlined and efficient method for distributing employee compensation. This electronic payment system directly transfers funds into designated bank accounts, eliminating the need for physical checks. Understanding the facets of direct deposit within this context contributes to efficient financial management and reinforces the overall effectiveness of the payroll system.

- Automated Payment Delivery:

Direct deposit automates the delivery of compensation, eliminating the need for manual check handling. Funds are electronically transferred to designated employee bank accounts on scheduled pay dates. This automated process reduces administrative overhead for the school district and ensures timely access to funds for employees. For example, funds are available on payday without requiring a trip to a bank or physical deposit.

- Enhanced Security and Convenience:

Direct deposit enhances security by eliminating the risk of lost or stolen physical checks. Funds are directly deposited into designated accounts, minimizing the potential for fraud or misappropriation. This method also offers convenience, eliminating the need for physical banking transactions. Employees can access their funds electronically on payday, regardless of location or bank branch hours.

- Reduced Environmental Impact:

By eliminating the need for paper checks and associated processing, direct deposit contributes to a more sustainable payroll system. Reducing paper consumption aligns with environmental responsibility and contributes to a more efficient resource management system within the school district.

- Integration with Financial Institutions:

Direct deposit requires seamless integration with financial institutions. Accurate bank account information is essential for successful transactions. Employees must provide and maintain accurate banking details to ensure timely and accurate deposits. The payroll system must securely interface with banking systems to facilitate these electronic transfers.

The integration of direct deposit within the Horry County Schools payroll schedule contributes to a more efficient, secure, and environmentally responsible compensation system. This electronic payment method streamlines the process for both the district and its employees, highlighting the importance of technological advancements in modern payroll management.

4. Payment Methods

Payment methods within the Horry County Schools payroll schedule represent the diverse options available for distributing employee compensation. Understanding these options is essential for employees to manage their finances effectively and ensure timely access to their earnings. A variety of payment methods contributes to a flexible and inclusive payroll system.

- Direct Deposit:

Direct deposit electronically transfers funds into designated employee bank accounts. This method offers convenience, security, and efficiency, eliminating the need for physical check handling. Most financial institutions are compatible with direct deposit systems, allowing for widespread adoption. For instance, an employee might designate their checking account to receive bi-weekly salary payments.

- Physical Checks:

While less common in modern payroll systems, physical checks remain a viable payment method. Checks provide a tangible form of payment and offer an alternative for employees who may not have access to traditional banking services. However, checks require manual handling and present a risk of loss or theft. An individual might receive a physical check if their banking information is unavailable or if they prefer a tangible payment method.

- Payroll Cards:

Payroll cards function similarly to debit cards, allowing employees to access their wages electronically. These cards can be used for purchases, ATM withdrawals, and online transactions. Payroll cards offer an alternative for employees who may not qualify for traditional bank accounts. They provide a secure and convenient way to access earnings without needing a checking account.

- Payoneer/Other Digital Payment Platforms:

Emerging digital payment platforms, such as Payoneer, offer potential alternatives for distributing compensation. These platforms facilitate international transactions and offer flexible payment options. While not as widely adopted as traditional methods, they represent potential innovations in payroll management, particularly for diverse workforces or international contexts.

The variety of payment methods within the Horry County Schools payroll schedule provides flexibility and accessibility for all employees. Offering multiple options ensures that individuals can choose the method best suited to their financial circumstances, contributing to a more inclusive and efficient payroll system. Understanding these options empowers employees to manage their earnings effectively and reflects the ongoing evolution of payment technologies within modern payroll practices.

5. Holiday Adjustments

Holiday adjustments represent a crucial element within the Horry County Schools payroll schedule, addressing the impact of holidays on standard pay dates and operational procedures. These adjustments ensure consistent and timely compensation for employees while accommodating closures and altered schedules during holiday periods. Understanding the relationship between holiday adjustments and the payroll schedule is essential for effective financial planning and maintaining consistent cash flow for district employees.

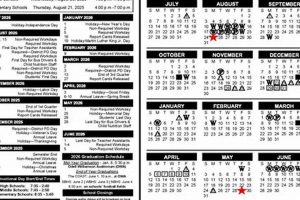

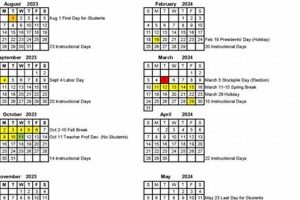

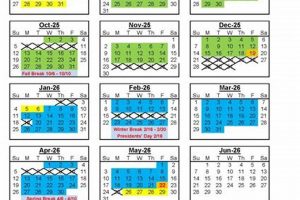

Holidays designated by the school district calendar often necessitate modifications to regular payroll processing. For instance, if a standard payday falls on a recognized holiday, the payment date may be shifted to the preceding or following business day. This adjustment ensures employees receive compensation without disruption, even when regular operations are suspended. The specifics of holiday adjustments, including which holidays trigger modifications and how pay dates are affected, are typically outlined within the official Horry County Schools payroll schedule or related policy documents. For example, holidays like Thanksgiving or Christmas, which result in school closures, necessitate adjustments to ensure employees receive their paychecks promptly. These adjustments might involve early payment processing or designated alternative pay dates. Failure to account for these adjustments could lead to temporary cash flow disruptions for employees relying on consistent pay cycles.

Understanding the impact of holiday adjustments on the Horry County Schools payroll schedule empowers employees to anticipate potential variations in pay dates and plan accordingly. This awareness facilitates proactive financial management, enabling individuals to meet financial obligations without disruption. Accessing and reviewing the official payroll schedule, including any published holiday adjustments, is crucial for maintaining accurate financial records and ensuring personal financial stability. This understanding fosters a more predictable and transparent compensation system, contributing to employee well-being and a smoothly functioning payroll process. Consistent and clear communication of holiday adjustments minimizes potential confusion and reinforces the district’s commitment to timely and accurate compensation.

6. Payroll Inquiries

Payroll inquiries represent an essential interface between employees and the Horry County Schools payroll schedule. Effective channels for addressing compensation-related questions or concerns contribute to a transparent and efficient payroll system. Understanding the available avenues for inquiry resolution empowers employees and reinforces the district’s commitment to accurate and timely compensation.

- Addressing Compensation Discrepancies:

Payroll inquiries provide a mechanism for resolving discrepancies between expected and received compensation. Employees can utilize established channels to address questions about salary calculations, deductions, or any perceived errors in their pay. For example, an employee might inquire about a discrepancy between their pay stub and anticipated earnings based on their contract. Prompt and accurate resolution of such inquiries is crucial for maintaining trust and ensuring fair compensation practices. A clear process for submitting and tracking inquiries contributes to a transparent and accountable payroll system.

- Clarifying Payroll Policies and Procedures:

Payroll inquiries offer an opportunity to clarify specific aspects of the Horry County Schools payroll schedule. Employees can seek clarification on topics such as pay dates, payment methods, holiday adjustments, or tax withholding. For instance, an employee might inquire about the specific dates for direct deposit payments or the procedures for updating banking information. Access to clear and readily available information regarding payroll policies and procedures promotes transparency and reduces potential confusion. Effective communication channels, such as online resources, dedicated helplines, or knowledgeable staff, facilitate efficient inquiry resolution.

- Accessing Payroll Records and Documentation:

Payroll inquiries can facilitate access to relevant payroll records and documentation, such as pay stubs, tax forms (W-2s), or direct deposit confirmations. Employees might require these documents for tax filing, loan applications, or other financial purposes. A streamlined process for requesting and receiving these documents contributes to an efficient and employee-centric payroll system. Secure online portals or designated contact points within the human resources or payroll departments facilitate secure and timely access to sensitive information.

- Reporting Payroll-Related Issues:

Payroll inquiries provide a formal channel for reporting payroll-related issues, including potential errors, system malfunctions, or concerns about data security. Employees play a crucial role in identifying and reporting potential problems, contributing to the overall integrity and effectiveness of the payroll system. A clear process for reporting issues and receiving follow-up ensures accountability and promotes continuous improvement. Effective communication channels, such as dedicated email addresses or confidential reporting mechanisms, encourage employees to report concerns without fear of reprisal.

Effective management of payroll inquiries is integral to the successful operation of the Horry County Schools payroll schedule. Clear communication channels, established procedures for inquiry resolution, and accessible resources empower employees to address compensation-related questions or concerns efficiently. This fosters transparency, reinforces trust, and contributes to a smoothly functioning payroll system, ultimately benefiting both employees and the district.

7. Access to Records

Access to payroll records forms a critical component of a transparent and functional compensation system within Horry County Schools. This access empowers employees to verify payment accuracy, understand deductions, and track earnings history, contributing to informed financial decision-making. Ready access to records also facilitates tax preparation, supports loan applications, and provides documentation for various financial transactions. For example, an employee might access pay stubs to verify the accuracy of deductions for health insurance or retirement contributions. Similarly, access to W-2 forms is essential for annual tax filing. Restricting access could hinder employees’ ability to manage personal finances effectively and create unnecessary administrative hurdles.

Several mechanisms typically facilitate access to payroll records. Secure online portals allow employees to access digital copies of pay stubs, tax forms, and other relevant documents conveniently. These portals often provide historical data, allowing individuals to track earnings and deductions over time. Alternatively, designated payroll or human resources departments can fulfill requests for physical or digital copies of records. Clear procedures for requesting records and established timelines for fulfilling these requests contribute to an efficient and employee-centric system. Furthermore, policies outlining data retention periods ensure compliance with regulatory requirements and provide employees with access to historical information within defined parameters. For example, an employee preparing for a mortgage application might request several years of W-2 forms to demonstrate consistent income history. A well-defined process facilitates timely access to these crucial documents.

Transparent access to payroll records fosters trust between employees and the institution, reinforces accountability within the payroll system, and contributes to a positive work environment. Clear policies governing access, secure methods for retrieval, and efficient procedures for fulfilling requests are essential components of a robust and equitable compensation system. Furthermore, readily available access empowers employees to take ownership of their financial well-being and promotes informed financial decision-making. Challenges may include balancing data security with accessibility and ensuring compliance with privacy regulations. Addressing these challenges proactively contributes to a secure and transparent system that benefits both employees and the institution.

Frequently Asked Questions

This section addresses common inquiries regarding the compensation system for Horry County Schools employees. Clear and concise answers promote understanding and facilitate effective financial planning.

Question 1: How often are employees paid?

Horry County Schools typically operates on a bi-weekly pay cycle, resulting in 26 paychecks per year. Specific details can be found in official documentation or by contacting the relevant administrative department.

Question 2: What happens if a payday falls on a holiday?

Pay dates falling on recognized holidays are typically adjusted. Payments are usually processed on the preceding business day. Specific holiday adjustments are outlined in the official payroll schedule.

Question 3: How can employees access their pay stubs and other payroll records?

Employees can typically access payroll records through a secure online portal or by contacting the payroll or human resources department. Specific procedures and access methods may vary.

Question 4: What methods are available for receiving compensation?

Common payment methods include direct deposit, physical checks, or payroll cards. Employees may have the option to select the method most convenient for their circumstances.

Question 5: How can one address a discrepancy regarding their pay?

Established procedures exist for addressing payroll discrepancies. Employees should contact the payroll or human resources department to initiate an inquiry and seek resolution.

Question 6: Where can one find further information regarding the payroll schedule and related policies?

Comprehensive information regarding the Horry County Schools payroll schedule is often available through official district publications, employee handbooks, or online resources. Contacting the human resources or payroll department can provide further clarification.

Understanding the nuances of the payroll system empowers employees to manage finances effectively. Consulting official resources or designated departments provides further clarification and personalized guidance.

For further information and details specific to individual circumstances, consulting official district resources or contacting the designated payroll or human resources department is recommended. This proactive approach ensures accurate understanding and facilitates effective financial planning.

Horry County Schools Payroll Schedule

This exploration of the Horry County Schools payroll schedule has highlighted key components, including payment frequency, pay dates, direct deposit mechanisms, available payment methods, holiday adjustments, processes for payroll inquiries, and access to records. Understanding these elements is crucial for effective financial planning and contributes to a transparent and efficient compensation system. Each component plays a vital role in ensuring timely and accurate payment distribution, facilitating financial stability for district employees.

Effective management of compensation is fundamental to a well-functioning organization. A clearly defined and accessible payroll schedule empowers employees to manage personal finances responsibly and contributes to a positive work environment. Continued review and refinement of payroll processes, incorporating technological advancements and best practices, will further enhance efficiency and transparency within the Horry County Schools compensation system. Access to readily available information and clear communication channels remain essential for addressing employee needs and maintaining a robust and equitable payroll system.